Widow's pension / Widower's pension (Witwen- or Witwer-Rente)

HOW MUCH, HOW LONG AND TO WHOM IS IT POSITIVE?

Your smile is in good hands: dental insurance!

Most of us have heard that in Germany, in the event of a tragic event with one of the spouses, the other receives the spouse's pension or part of it. This is true, BUT not always and not in full.

Let's look at the issue in more detail.

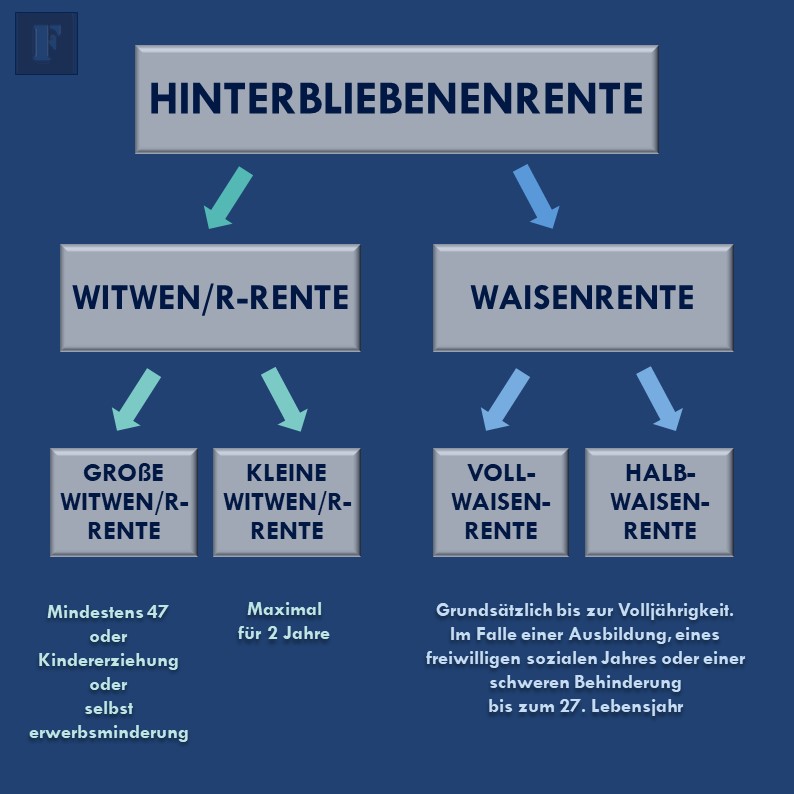

But first, we will consider in the diagram below the possible options for obtaining a survivor's pension (Hinterbliebenenrente).

Hinterbliebenenrente - survivor's pension

Witwen-Rente – widow's pension

Große Witwen Rente - large widow's pension

Kleine Witwen Rente - small widow's pension

Waisenrente – orphan's pension

Vollwaisenrente – full orphan's pension

Halbwaisenrente – half of the orphan's pension

Now let’s take a closer look at the widow’s pension or widower’s pension (Witwen- or Witwer-Rente).

So, the prerequisites for receiving a widow's pension:

Spouses must have been married for at least 1 year. But, if an accident occurs, then the term is not taken into account.

The deceased is already receiving a pension or should have made at least 60 payments to the German pension fund (DRV – Deutsche Rentenversicherung). In case of an accident at work, the number of payments is not taken into account.

After this three month period, the following two options are possible:

Great Widow's Pension (Große Witwen / r-Rente)

Small Widow's Pension (Kleine Witwen / r-Rente)

Now let's figure out what conditions must be met to receive Great widow's pension (Große Witwen Rente).

It is paid if at least one of the following conditions is met:

The remaining spouse is disabled (erwerbsgemindert);

The remaining spouse raises his own or the deceased’s minor children. The payment period is until the children reach adulthood. And this condition applies to cases even when the spouses were divorced;

If the deceased has a disabled child (behinderte Kind), the pension is paid even after the age of majority;

The remaining spouse is over 45 years and 10 months (in 2021). This age is gradually increasing. So, from 2029, the pension will be paid if the spouse is over 47 years old.

How is the Great Widow's Pension calculated?

Its size is a maximum of 55% of the pension that the deceased received or could receive.

But a higher percentage is also possible, namely 60%, if the marriage was concluded before 2002, or the spouses were born before 1962.

If the deceased was under the age of 65, then the pension is reduced by 0,3% for each month. At the same time, the maximum possible reduction in pension is 10,8%. (Thus, the minimum size for Große Witwen Rente is 44,2%).

The reduction in the amount of the pension also applies to childcare. If the remaining spouse is under 65, then the pension is also reduced by 0,3% for each month, but not more than 10,8%.

How long is the Great Widow's Pension paid?

The large pension is paid for life or until remarriage. In case of remarriage, the spouse receives compensation (Abfindung) in the amount of 24 monthly payments.

In all other cases, the remaining spouse receives Little Widow's Pension (Kleine Witwen / r-Rente).

How is the Small Widow's Pension calculated?

Its size is 25% of the deceased's pension.

How long is the minor widow's pension paid?

The pension is paid for only 2 years, that is, 24 monthly payments.

In case of remarriage, a one-time compensation is paid from the remaining 24 payments.

If the marriage was concluded before 2002 or one of the spouses was born before 1962, then the small pension is paid for life.

Link to the official source of information - German Pension Fund (DRV – Deutsche Rentenversicherung).

Still have questions? Write us and we will answer you in detail.

Hello! How long must spouses be married to receive a widow's pension?

Good afternoon,

There are several conditions for receiving a widow's pension. First of all, the spouses must have been married for more than one year.

Also, the spouses must have minor children or the surviving spouse, according to general conditions, must be 47 years old.

Hello! My husband is German; he died in Germany due to illness and was given a pension of 2500 euros. We were married in 2008 and lived together in Munich, and then in 2019 I went to Russia to visit my daughter and stayed there, we kept in touch and did not divorce, and on 22.12.2024/57/XNUMX he died but left a letter where he wrote that I should formalize pension and receive it. Tell me, do I have the right to receive it and how can I apply for it if I live in Moscow and my residence permit has long expired and do I need to go to Germany to apply for a pension or can this be done while here in Moscow? I am XNUMX years old

Lily, hello.

Your entitlement to a widow's pension in Germany is determined by German pension law. Since your spouse was insured in Germany, you are most likely entitled to a widow's pension.

Here are the steps you may need to take:

1. Establishing entitlement to a pension: You will need to prove your entitlement to a widow's pension. This usually includes providing the spouse's death certificate, marriage license, spouse's insurance history, and other documents.

2. Applying: Typically, to apply for a pension, you do not need to be in the country in which the pension will be paid. Embassies and consulates often provide this service, or you can use mail or online services.

3. Embassy Assistance: The German Embassy or Consulate in Russia can provide you with information and help with the application process.

Whether you need to return to Germany to claim your pension depends on many factors, including the requirements of the German pension fund and whether you can submit documents through diplomatic or consular offices. It appears that you will not have to return to Germany for this process, but you can be sure to check this point by contacting the German pension fund or embassy.

Good afternoon, I would like to thank you for your advice and help people. I knew a lot of cinnamon here. Mayu is also a foodie. I’m taking my widow’s pension, I still live and work in Germany, but sometimes I want to return to the Fatherland, to Ukraine, so my food is this: how can I get my German widow’s pension in Ukraine, if I need it? and will pay taxes from it to Nimechchina, as I plan to turn back. How much should I change my pension upon moving to Ukraine, since it amounts to 600 euros? And one more meal. My dead man had additional pension insurance for having paid the employer for at least 16 years. When contacting the insurance company for payments, I am not convinced. The insurance company is committed to those who are transferred by the contract “Bei Tod der versicherten Person vor Beginn der Rentezahlung wird keine Todesfallleistung faellig und Versicherung erlischt”. I am the sole repository of a dead person and I collect the official documents. Dyakuyu.

Good afternoon.

You can receive a German pension while living not only in Germany. This way you can continue to receive it when you return to Ukraine.

For the current year, 11 euros per year are tax-free in Germany.

Regarding your second question, you need to look at the contract. And if it really does not provide for payments in the event of death before pension payments, then this is indeed the case.

Good afternoon, I received a widow’s pension in September, but received the first one only in March, am I entitled to payment for all months from the date of registration of the pension, that is, from September? If so, what needs to be done to get everything paid? I work, will tax be deducted from the widow's pension and in what amount?

In Germany, when you apply for a widow's pension (Hinterbliebenenrente), you are actually entitled to payments for the entire period from the moment you are entitled to receive them until the actual start of payments. If you applied for a pension in September, but the first payment arrived only in March, you must be paid the debt for all previous months.

Regarding taxation, pensions are subject to taxation in Germany. Your widow's pension will be included in your total annual income and taxed at your individual tax rate. The amount of tax depends on your total annual income, which includes both your salary and any pension received.

Hello, I have been receiving a widow's pension since 2019, in 2023 I moved to Australia to be with my daughter. There were large delays in transferring my pension; as of today, I have not received my pension for the last 3 months. Numerous calls to Knapschaft, filling out forms, sending by mail and electronically, does not produce results. Where can I go for help with this matter?

And one more question: can I arrange for the transfer of my German widow’s pension to Russia at the present time?

Hello.

In your situation, there are several ways that can help solve the problem of transferring a pension to Australia, as well as the possibility of transferring a pension to Russia, although this will most likely be problematic.

To solve the problem of pension delays:

German Embassy or Consulate in Australia: Contact the consular section of the German Embassy or Consulate in Australia. They can provide advice and support on issues related to social benefits and pensions for German citizens abroad.

But first of all, you need to contact the pension fund and confirm that you are there. Previously, this had to be done through the DHL office.

Good afternoon!

My retired husband died in Germany. I have been living in Ukraine for a year due to life circumstances. How can I apply for a widow's pension? Can this be done without personal presence in Germany? I have no idea where to start. And is it possible to entrust this matter to a lawyer? Thank you.

Hello.

If you are entitled to a widow's pension, i.e. your husband received a German pension, it is better to do this through a trusted lawyer.

But what about the husband’s debts? After the death of my husband, a decent amount of credit card debt remains. I became aware of these debts after his serious illness. What awaits me, I would like to know. Am I obligated to pay his debt?

In Germany, as in many other countries, debts can be transferred to heirs after the death of the debtor. However, there are some nuances that are important to consider:

Inheritance of debts: By default, heirs assume responsibility for the debts of the deceased, along with his assets. This means that if you are your husband's legal heir, then unfortunately you will also inherit his debts.

Refusal of inheritance: In Germany, heirs have the opportunity to refuse inheritance, which includes both assets and debts. The waiver must be in writing and filed with the appropriate court within a specified period of notification of death (usually 6 weeks).

Limited Liability: If you accept an inheritance but want to limit your liability to only the estate, in Germany there is a process called “Nachlassverwaltung” (inheritance administration). This means that your personal liability for debts is limited to the value of the estate.

Risikolebensversicherung and other policies: Sometimes debts can be covered through the deceased's life insurance or other types of insurance, if available.

Consulting a Lawyer: It is important to consult with a lawyer in Germany to fully understand your responsibilities and rights. They will be able to provide you with personalized advice based on your unique situation.

Credit Card Debt: The specifics of credit card debt can vary depending on the terms of the agreement and the issuing bank. Therefore, in addition to general legal advice, you may also need to discuss this issue directly with the bank.

Remember that every situation is unique and you should get personalized help for your specific case. If you have any further questions about financial or insurance products in Germany, please contact us.

Hello! Am I entitled to receive a widow's pension if I do not have German citizenship? I have a residence permit, which is renewed every three years. My husband is 80 years old, he prepared all the documents so that it would not be difficult for me to do this. I live in two countries, a month in Germany, two months in Russia.

Hello!

Receiving a widow's pension in Germany is not necessarily related to having German citizenship. Important conditions for receiving a widow's pension are proof of legal marriage, residence in Germany and contributions to the country's pension system by the deceased spouse. A residence permit (residence permit) allows you to live and work in Germany, and can also be taken into account when applying for a pension.

In your case, if you live in Germany and your spouse has made the required pension contributions, you can claim a widow's pension upon his death. The fact that you live between two countries does not disqualify you from receiving a pension, but it may affect the application process.

If a husband was paying for the premium rate of Krankenversicherung from his wages, when the wife opts to continue to pay for 'Krankenversicherung' from the Widow's pension, will she also have to pay for the premium rate or can she choose to pay for the public cheaper rate? As she will have a reduced amount of Rent?

If a widow is receiving a pension, her health insurance typically continues, with contributions automatically deducted from her pension. The rate is based on her income and other factors. Switching from private to public insurance isn't easy and depends on specific eligibility criteria. It's best for her to consult with her current health insurance provider for precise guidance.

Hello good day.may I ask if there is others benefits i can claim from my husband after he died except from my widow pension?or any insurance of him?because i only claim my widow pension after his death.

I'm not an attorney, but there are several factors that might affect what benefits or claims you might be entitled to in Germany after the death of your spouse. Some possible areas to explore include:

Life Insurance: If your husband had a life insurance policy, you might be entitled to receive a payout as the beneficiary. It would be important to have a copy of the insurance policy and to contact the insurance company directly to understand the procedure for making a claim.

Accident Insurance: If your husband's death was the result of an accident, and if he had accident insurance, there might be benefits available to you as a result.

Occupational Pensions: If your husband was employed, he might have been enrolled in an occupational pension scheme. You should contact his former employer to find out if there are any survivor benefits available to you.

Other Social Insurance Benefits: There might be other types of social insurance benefits available to you as a widow, such as unemployment benefits if your husband's death affects your own employment situation.

Savings and Investments: Any savings accounts, investments, or other assets your husband had might now belong to you, or be part of his estate. You may need to consult with an attorney to understand how these assets will be distributed.

Real Estate: If your husband owned property, you may have rights to that property either alone or as part of his estate.

Inheritance: Depending on the laws in Germany and whether or not there's a will, you may be entitled to inherit certain assets from your husband.

Tax Benefits: There may be tax benefits available to you as a widow, such as a change in your tax filing status or potential deductions.

It's advisable to consult with a legal professional who is familiar with German law to get a better understanding of what claims or benefits might be available to you. There might be specific deadlines or procedures that need to be followed to ensure that you receive all the benefits to which you are entitled.

Keep in mind that laws and procedures can change, and a professional will have the most current information to help guide you through the process.

Hello, am I entitled to receive a widow's pension from my husband, who died, but we were divorced, we were married from 1992 to 2011, after the divorce, neither he nor I married other people?

Thank you!

Hello!

In Germany, the right to a widow's pension (Witwenrente or Witwenpension) depends on many factors, and one of the main ones is the length of the marriage. Your marriage lasted 19 years, which is a significant period. However, given that you are divorced, you need to consider the following:

Entitlement to a divorced widow's pension (Geschiedenen-Witwenrente): If you divorced your husband but neither of you remarried before his death, you may be entitled to a so-called divorced widow's pension. This is usually less than a normal widow's pension and you will need to demonstrate that you cannot provide for your basic needs without this pension.

Length of Marriage: Typically, to be eligible for a pension, the marriage must last a certain number of years. Your marriage lasted 19 years, which is long enough in most cases.

Age: Age may also affect eligibility for a widow's pension, especially when considering a “divorceable” widow's pension.

Other conditions: There may be other conditions, such as financial status or having children, that may affect your eligibility for a pension.

In practice, the best solution is to contact your local social insurance office (Deutsche Rentenversicherung) or a legal adviser specializing in pension law to clarify all the details of your specific case. Some nuances may depend on the region of residence and other individual factors.

I hope we were able to answer your question.

Hello.

I work, I'm 65 years old. I work 73 hours a month. Minimum rate payment. How will this affect the widow's pension?

Thank you

Hello.

I work, I'm 65 years old. I work 73 hours a month. Minimum rate payment. How will this affect the widow's pension?

Thank you

Hello!

The German pension system is complex and depends on many factors. The basis for calculating the pension is the total amount of contributions paid into the German pension system during your entire life. The amount of the widow's pension depends on the size of the deceased spouse's pension, and usually the widow or widower receives a percentage of the deceased spouse's pension.

In Germany the following standard rates apply for widow's pensions:

Large widow's pension (Große Witwenrente) - 55% of the deceased's pension.

Your salary does not in any way affect the amount of widow's pension you are entitled to.

Best regards,

FinBer Team