In Germany, a country with a highly developed economy and attention to the social protection of its citizens, the insurance system is built on the principles of reliability and comprehensiveness. In this article we will look at 7 important more types of insurance that not only complement compulsory types of insurance, but are also an integral part of financial planning and provide an additional level of protection superior to standard insurance policies.

Mandatory insurances such as private health insurance or state health insurance, as well as automobile Kfz, discussed in separate articles.

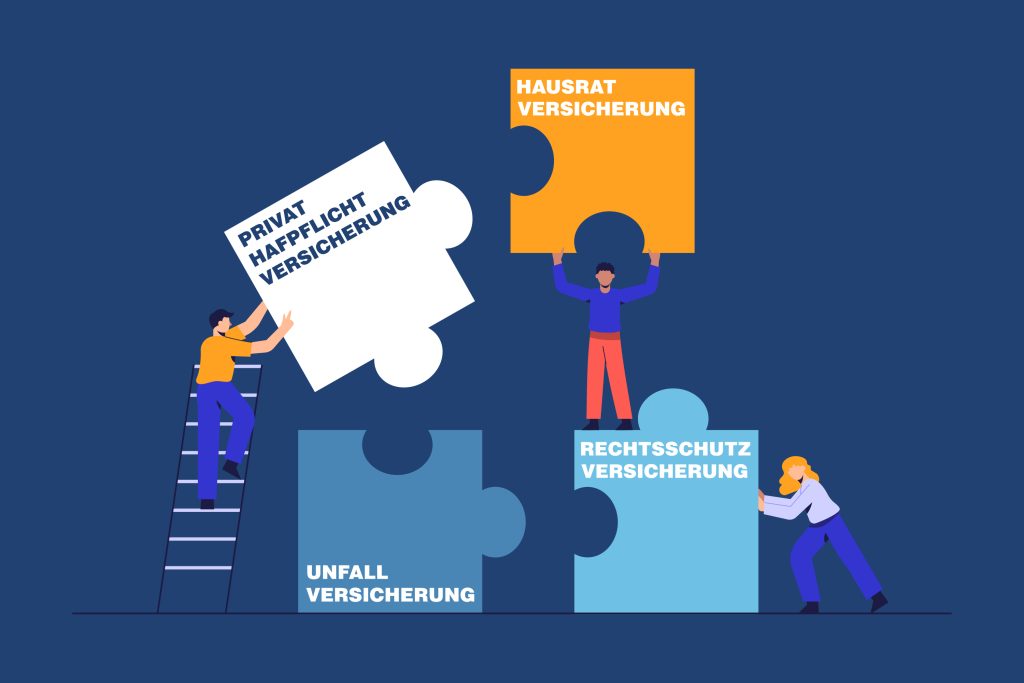

The seven most important additional insurances:

Privathaftpflichtversicherung - civil liability insurance.

For about 5 euros per month, you can insure yourself and your family in case of damage to third parties in the amount of 5 million euros or more.

This insurance policy guarantees protection from a third party claiming damages.

Recommended for families with children. Protects if a child breaks something in a public place, for example, hits a parked car with a bicycle or smashes a monitor at a school.

Examples of when this policy can come in handy:

- You accidentally break your friend's new phone at a party.

- You lose the key to the common entrance door in an apartment building and the lock needs to be replaced. Average cost about 2'000 €

- You don't notice the cyclist and he gets into an accident and injures his leg. Insurance will pay for expensive treatment

- You hit someone else's car with a cart in a supermarket parking lot and damaged it. The insurance will pay for the repair.

- As a result of a short circuit in your apartment, a fire occurs that damages the neighboring apartment. Insurance will pay for repairs to neighbors

Additional options:

- Professional responsibility

- Damage associated with friendly services - for example, dropping a friend's laptop while receiving free moving assistance

Cases when the policy DOES NOT WORK:

- Damage caused to yourself or to people insured with you in the same contract (family members)

- Intentional or unlawful damage

Need help choosing insurance? Write us and we will answer your questions in detail.

Berufsunfähigkeitversicherung (BU) - insurance in case of professional disability due to illness, injury, accident, etc.

Your profession, your skills are an opportunity to have a good, well-paid job. What happens to your income if you have a serious illness, an accident, or if you are unable to work in your profession?

Insurance for loss of professional performance (Berufsunfähigkeitversicherung, abbreviated BU) provides you with a regular monthly pension in the event that your current health condition prevents you from continuing to work in your current professional field.

Standard payments for this insurance range from 1 euros per month. Without a BU, you can count on disability benefits of about 000% of your salary and only in case of serious illness if you are unable to work more than 30 hours a day.

This insurance will be useful for those whose main income comes from one family member and its loss will negatively affect the family budget.

According to statistics, the following diseases are the cause of disability:

- Mental and nervous diseases - 32%

- Diseases of the musculoskeletal system - 21%

- Cardiovascular disease - 15%

- Cancer - 15%

- Accidents - 9%

- Other - 8%

Hausratversicherung – insurance of household property against possible damage as a result of an accident

We all have valuables at home - paintings, a new big flat-screen TV, expensive furniture. What happens to this in case of theft or water leakage or fire? Valuable items may be irretrievably lost or damaged.

In this case, home contents insurance will come in handy - Hausratversicherung. This policy will compensate you for losses within the framework of the contract. The cost will be refunded as for a new item.

You can enable options for furniture owned by the landlord. Or damage from pets.

What can be insured Hausratversicherung?

- Furniture

- Home Appliances

- Money

- Apparel

- Valuables

- Electrical appliances

What can you insure your home contents against?

- From water, fire, explosion

- From burglary

- From hail, lightning strikes, storms

Additional options:

- Bike theft insurance

- Anti-theft protection while traveling

- Glass insurance

- Online protection against financial risks on the Internet

- Disaster Protection

Rechtsschutzversicherung – the so-called “Lawyer insurance”

In the event of an emergency, private legal protection insurance covers legal costs, consultations, and pre-trial settlement. Sometimes one letter from a lawyer is enough to resolve the issue amicably.

Care must be taken to ensure that the area of interest you are interested in is included in the policy.

Main sections of insurance coverage for legal expenses:

- Private law - Privatrechtsschutz. This includes disputes with a neighbor over noise or an improperly installed fence. With the seller regarding defective goods and their return. Divorce disputes are limited to attorney's insurance.

- Employer-related disputes - Berufsrechtsschutz. Professional legal protection can be useful for both self-employed people and company employees. Will help in court or if you did not receive a job recommendation, were not promoted in accordance with the agreement, or received an unreasonable warning or penalty.

- Road disputes - Verkehrsrechtsschutzversicherung. It will be useful not only for resolving a dispute with another road user, but also in case of illegal deprivation of a driver’s license or an incorrectly imposed fine.

- Rental disputes - Wohnung Rechtsschutzversicherung. Disputes related to eviction, increase or decrease in rent, damage to property. Useful for both landlords and tenants.

Easily and quickly calculate the cost of lawyer insurance depending on the selected services:

Unfallversicherung - accident insurance

During working hours everyone is insured. But statistics say that about 75% of accidents occur outside the workplace.

Slipping in the bathroom, falling off your bike, getting hurt on vacation. In all these cases, accident insurance can help.

What are the advantages? Unfallversicherung?

- Payment of a lump sum of money

- Lifetime disability pension available

- Search and rescue payments available

- A one-time payment to relatives in the event of death from an accident (even if the death occurred within 1-2 years after the incident)

- Coverage for cosmetic and plastic surgeries is possible if the accident affected the appearance

- Operates XNUMX/XNUMX worldwide

Who will do?

- For private entrepreneurs

- People with an active lifestyle and hobbies with a high risk of accidents.

- People without work

We discussed in more detail Unfallversicherung in this article.

We discussed in more detail Unfallversicherung in this article.

Risikolebenversicherung - life insurance.

A fairly inexpensive policy, usually with a payment of € 100'000. In the event of the death of the insured, close relatives receive a significant benefit.

When to consider this insurance:

There are large loans that need to be closed. For example – Mortgage.

You are the main earner in the family.

You want to be sure that if something happens to you, your loved ones will be financially protected.

Beneficiaries can be both relatives and, for example, a charitable foundation.

Zahnzusatzversicherung – additional dental insurance.

Often, dental treatment in Germany becomes a very expensive undertaking, while state health insurance only partially compensates for the costs, paying mainly only for the necessary and basic methods of solving the problem.

Supplemental dental insurance is designed to provide financial coverage for modern treatments using high-tech and durable materials. In the case of prosthetics, additional treatment or orthodontic procedures, this insurance will cover most or all of the costs.

We compared several companies and analyzed this type of insurance in detail. on this page:

Need help choosing insurance? Write us and we will answer your questions in detail.

More information about the seven main additional insurances in Germany in our video:

You are currently viewing a placeholder content from Youtube. To access the actual content, click the button below. Please note that doing so will share data with third-party providers.

More InformationWir wollen mit unseren Empfehlungen möglichst vielen Menschen helfen, ihre Finanzen selber zu machen. Daher sind unsere Inhalte kostenlos im Netz verfügbar. Wir finanzieren unsere aufwändige Arbeit mit sogenannten Affiliate Links. Diese Links kennzeichnen wir mit einem Sternchen (*).

(*) value:

With our recommendations, we want to help as many people as possible to manage their finances. We fund our work with affiliate links. We mark these links with an asterisk (*).