SOCIAL CHARGES IN 2021

Let's analyze what social contributions are in Germany.

There are two types of employee deductions: social benefits and income tax.

Let's take a closer look at SOCIAL DEDUCTIONS from wages.

In most cases, they are paid 50% by the employee and 50% by the employer.

First, all social security contributions are calculated from 100% of the gross salary. Only then the income tax is charged.

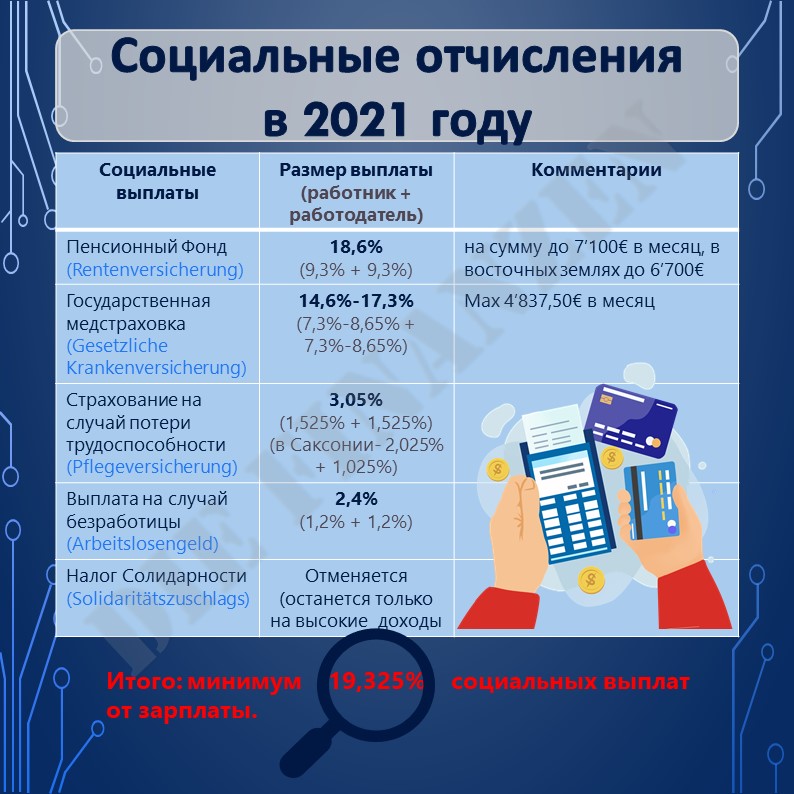

Social payments in 2021:

Social payments in 2021:

Pension Fund (Rentenversicherung) - 18,6%.

Pension Fund (Rentenversicherung) - 18,6%.

9,3% each - both an employee and an employer.

The payment is calculated in an amount of up to 7'100 € per month in the Western Länder (in 2020 - 6'900 €). In the eastern lands 6'700 € (in 2020 - 6'450 €).

Of course, we are talking about compulsory deductions. Nobody limits voluntary contributions to private pension funds.

Riester-Rente – additional pension.

State health insurance (Gesetzliche Krankenversicherung)– 14,6%-17,3%.

State health insurance (Gesetzliche Krankenversicherung)– 14,6%-17,3%.

7,3%-8,65% – both the employee and the same amount as the employer (varies in different states).

The maximum amount that must be paid into insurance in 2021 is 4 € per month or, accordingly, 837,50 € per year.

Disability insurance (Pflegeversicherung) - 3,05%.

Disability insurance (Pflegeversicherung) - 3,05%.

1,525% each - both an employee and an employer.

In Saxony, employees pay a little more - 2,025% and the employer pays 1,025%.

Unemployment benefit (Arbeitslosengeld) – 2,4%. 1,2% each side.

Unemployment benefit (Arbeitslosengeld) – 2,4%. 1,2% each side.

Solidarity Tax (Solidaritätszuschlags). The tax was introduced in 1991 for 1 year, but it still exists. The purpose of the tax is to restore the eastern lands (formerly the GDR).

Solidarity Tax (Solidaritätszuschlags). The tax was introduced in 1991 for 1 year, but it still exists. The purpose of the tax is to restore the eastern lands (formerly the GDR).

Good news: from 2021, 96,5% of residents of Germany, this tax will be significantly reduced or completely abolished. The tax will remain in the same amount only for people with high income (from 96'409 € for a single person and from 192'818 € for a family citizen).

Good news: from 2021, 96,5% of residents of Germany, this tax will be significantly reduced or completely abolished. The tax will remain in the same amount only for people with high income (from 96'409 € for a single person and from 192'818 € for a family citizen).

From 2021, a family with 2 children and an income of up to 151'000 € is exempt from tax.

A single citizen is exempt on income up to 73'000 €; everything that is from above is taxed.

Total: we pay at least 19,325% of social benefits from wages.

Total: we pay at least 19,325% of social benefits from wages.

Total: we pay at least 19,325% of social benefits from wages.

Social payments in 2021:

Social payments in 2021:

Total: we pay at least 19,325% of social benefits from wages.

Total: we pay at least 19,325% of social benefits from wages.