ETF Sparplan: ETF SAVINGS PLAN - HOW DOES IT WORK?

❗ ETF Savings Plans are some of the best and most convenient ways to build assets with small installments.

You can read about ETFs (Exchange Traded Funds) and brokers at previously published article.

What is an ETF Savings Plan?

The Sparplan ETF is similar to the bank savings plan. You regularly (monthly for example) invest an equal amount of money in an ETF that tracks a stock market index, for example DAX or the S&P 500 and thus you can easily invest in the whole market, even with small amounts. In addition, if savings are saved regularly, you will also benefit from compound interest.

Can easily invest in the whole market, even with small amounts

❓How it works:

▪You need to have a DEPOT brokerage account. Where and how can you open it we told earlier .

▪You select one or more ETFs for your Sparplan ETF. The filtered selection can be viewed on the website extraETF.

▪Determine the amount of deductions. For example 50 € per month.

▪Interval of deductions: monthly, quarterly, etc.

▪Date of execution. For example the 1st of every month.

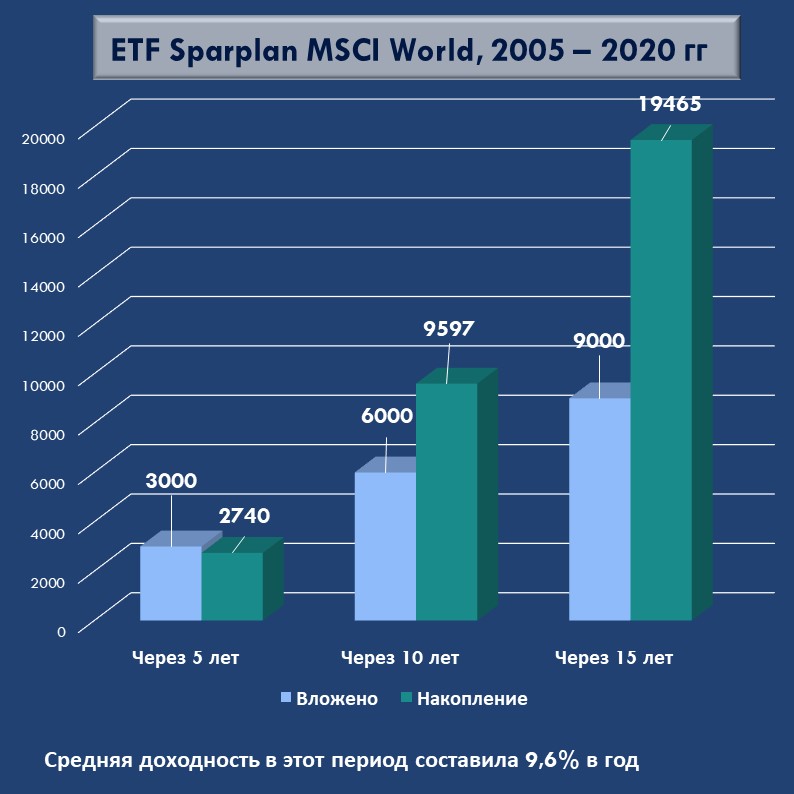

Below is an example of the development of the MSCI World ETF savings plan over the past 15 years, with a monthly contribution of 50 €. The average yield was 9,6%. But we should never forget that profitability in the past does not guarantee profitability in the future. MSCI World (short for Morgan Stanley Capital International World Index) tracks the growth of shares of 23 developed countries (Australia, Austria, Belgium, Great Britain, Germany, Hong Kong, Denmark, Israel, Ireland, Spain, Italy, Canada, the Netherlands, New Zealand, Norway, Portugal, Singapore, USA, Finland, France, Switzerland, Sweden, Japan). As of the beginning of 2021, the index includes 1582 companies. The index level serves as an indicator of the state of the global stock market.

Despite the 2008 crisis and a significant drop in the markets, we can observe a steady increase in the indicators of the MSCI World ETF over a 15-year period.

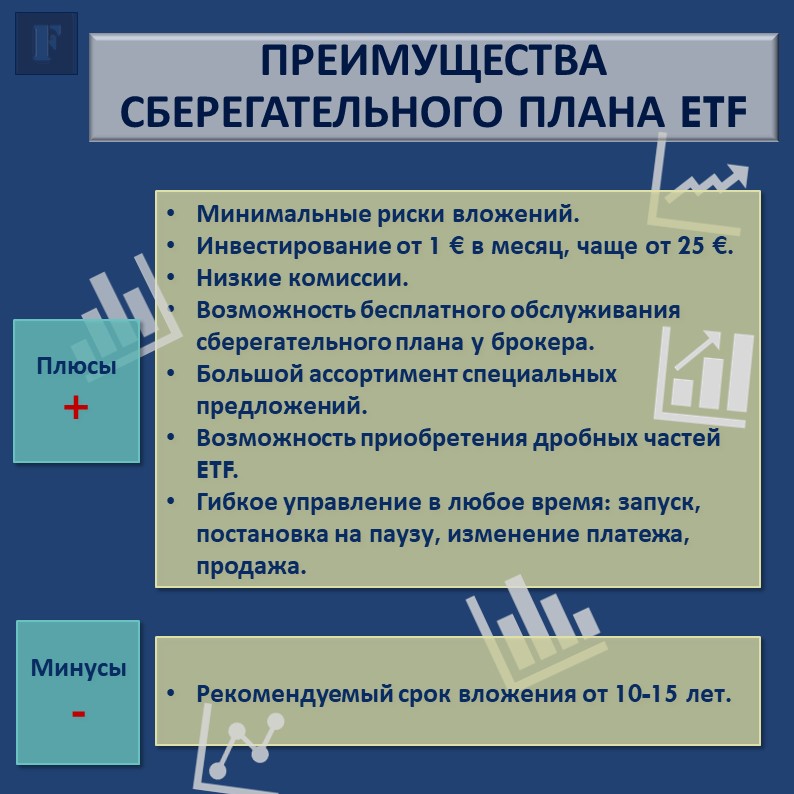

✔️The benefits of an ETF savings plan are obvious, see the picture:

🔹Recommended savings period is at least 10-15 years. So, making regular investments of small amounts, and benefitting from compound interest, you can accumulate significant amounts.

It should never be forgotten that profitability in the past does not guarantee profitability in the future.

Still have questions? Write us and we will answer you in detail.

Wir wollen mit unseren Empfehlungen möglichst vielen Menschen helfen, ihre Finanzen selber zu machen. Daher sind unsere Inhalte kostenlos im Netz verfügbar. Wir finanzieren unsere aufwändige Arbeit mit sogenannten Affiliate Links. Diese Links kennzeichnen wir mit einem Sternchen (*).

(*) value:

With our recommendations, we want to help as many people as possible to manage their finances. We fund our work with affiliate links. We mark these links with an asterisk (*).